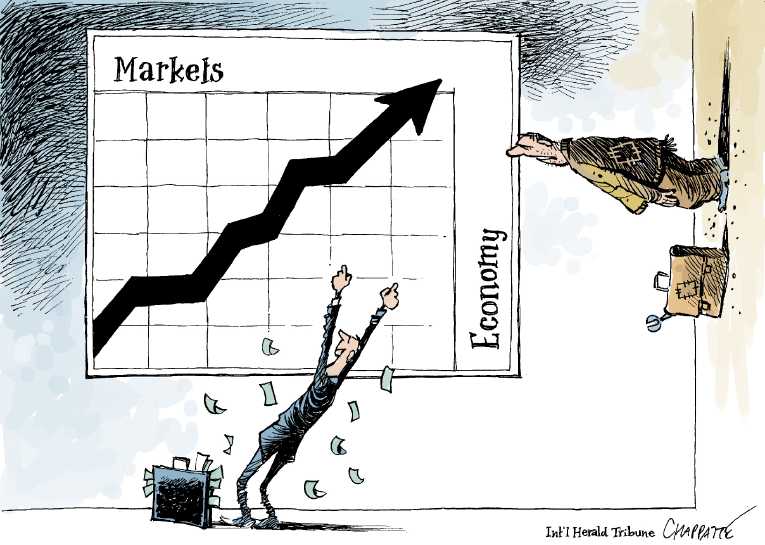

Markets are getting too euphoric, with indices turning near to all time highs. This is total contradiction to the ground realities. On ground, industry is still living with hope and possibilities. Banks are in dire-most state and Messihas aka Rajans are evicted - one can understand where the puck is going.

The wind sector story which started with too many bells and whistles, isn't being supported on ground level. Evacuation of electricity/payment by SEBs is still problem. The focus of investors is shifting towards Solar, where IRRs r lower, but evacuation is not a problem yet, as its size is tiny compared to wind.

Wat concerns me presently is the velocity of rate of change in tech ecosystem, which is disturbing each-and-every industry. Robotics/AI/Drones/synthetic bio/VR/batteries/fintech are changing at a rapid speed. I worry, that this will lead to unemployment, chaos, decrease in earning power of masses, and more inequality, with power shifting in hands of very few people eventually - looks like there will be only 2 classes - cash rich and credit rich. Labour intensive states can lose 'labour-cost-advantage' in age of cheap robots. Already job-creation is a nightmare. This is wat Jeff Weiner, linkedin guy, wrote in recent letter.

"Remember that dystopian view of the future in which technology displaces millions of people from their jobs? It's happening. In the last three weeks alone, Foxconn announced it will replace 60,000 factory workers with robots, a former CEO of McDonald’s said given rising wages, the same would happen throughout their franchises, Walmart announced plans to start testing drones in its warehouses, and Elon Musk predicted fully autonomous car technology would arrive within two years."

Considering that, we are looking for industries where rate of change is less/they are helped by the new technologies.

The capital raised is undeployed as valuations of desirables did not come in our range. Will wait.